HAVE ANY QUESTION? CONTACT US

- Alexandria, Virginia

- Atlanta, Georgia

- Auburn, Maine

- Bay City, MI

- Dearborn, Michigan

- Denver, Colorado

- Grand Rapids, MI

- Los Angeles, California

- Miami, Florida

- Norton Shores, Michigan

- New Orleans, Louisiana

- Norwalk, Connecticut

- Philadelphia, Pennsylvania

- Portland, Oregon

- Stamford, Connecticut

- Seattle, Washington

- Tulsa, Oklahoma

- Wetumpka, Alabama

Choose Qualified Mortgage Brokers and Lenders in the US

An industry leader in new home purchases,

refinancing and reverse mortgages.

refinancing and reverse mortgages.

Get Your Free

Mortgage Consultation

Fill Out The Form Below For a Complimentary Consultation With Our Mortgage Broker.

Mortgage Quote

Want to know about our mortgage services in detail? Fill out our online form and get a customized quote today!

Mortgage Calculator

Get an accurate estimate of the mortgage loan amount and monthly payments with the mortgage calculator!

Mortgage Refinance

Want to refinance your existing mortgage? Apply online to get expert mortgage refinancing assistance now!

Loan Application

Want to apply for a loan? Get in touch with us and fill in the loan application to get a quick mortgage loan.

RELY ON PIERPOINT MORTGAGE

THE TRUSTED BROKERS AND LENDERS

If your real estate agent has helped you find the right house, the next thing on the list will be getting a mortgage loan. Now, getting a mortgage loan on your own can be a real struggle; you might feel confused between turning to credit unions, a bank, or direct lenders.

We understand the dilemma of choosing between an experienced mortgage broker vs lender, but we have just the right option for you. You must consult with our experienced brokers to find the best loan programs. Moreover, with just a little help from our experienced mortgage brokers & mortgage lenders, you can get over the whole process in just a few steps!

PierPoint Mortgage can help you find the right mortgage loan from a trusted mortgage lender, at competitive rates! We offer different types of mortgage loans from multiple lenders. We will help you find the best-suited option from the following list!

CONVENTIONAL LOAN MORTGAGE

A conventional loan is different from any government house program. It can suit the needs of almost every house buyer, be it the first-time homebuyer. It can either be a fixed-rate or adjustable-rate mortgage. You need to have a good credit history for the approval of this loan.

Want more information on Conventional Mortgage?

Apply Now Mortgage!FHA LOAN MORTGAGE

Buying a home for the first time using a mortgage could seem a bit tough. FHA loan is a popular home loan when it comes to first-time homebuyers. FHA loans don’t have complex requirements to get approved. People who have always purchased a home using a mortgage can go for this option.

WANT MORE INFORMATION ON FHA LOAN MORTGAGE?

Apply Now Mortgage!VA LOANS MORTGAGE

The team of PierPoint Mortgage always welcomes everyone who is serving or has served in the military. We have VA loans that can help our veterans to become proud homeowners. There is no requirement for the down payment of this loan and the approval requirements are not strict.

WANT MORE INFORMATION ON VA LOANS MORTGAGE?

Apply Now Mortgage!JUMBO LOANS MORTGAGE

Some people might need a loan that exceeds the conforming loan limit set on mortgages eligible for purchase by Fannie Mae and Freddie Mac. For them, the Jumbo loan would be a perfect name to go with. The requirements, however, are a bit strict and lengthy but the team of PierPoint Mortgage is there to help you with every challenge.

WANT MORE INFORMATION ON JUMBO LOANS MORTGAGE?

Apply Now Mortgage!USDA LOAN MORTGAGE

Do you want to build your own house in a rural area? If yes, then USDA loans would be a perfect fit for your financial requirements. This loan is specifically for people having low-income who dreams of becoming a homeowner. In case you fail to get a conventional loan, you can always go for a USDA loan.

WANT MORE INFORMATION ON USDA LOAN MORTGAGE?

Apply Now Mortgage!REVERSE MORTGAGE

A reverse mortgage is a process that allows senior citizens (62 years of age or older) to obtain cash in exchange for equity in their homes. You can use the amount to pay off medical bills, consolidate debts, or cover any other expense. We provide all types of reverse mortgages, including, HECMs, proprietary, and single-purpose reverse mortgages.

WANT MORE INFORMATION ON REVERSE MORTGAGE?

Apply Now Mortgage!

CONVENTIONAL LOAN

A conventional loan is different from any government house program. It can suit the needs of almost every house buyer, be it the first-time homebuyer. It can either be a fixed-rate or adjustable-rate mortgage. You need to have a good credit history for the approval of this loan.

FHA LOAN

Buying a home for the first time using a mortgage could seem a bit tough. FHA loan is a popular home loan when it comes to first-time homebuyers. FHA loans don’t have complex requirements to get approved. People who have always purchased a home using a mortgage can go for this option.

VA LOANS

The team of PierPoint Mortgage always welcomes everyone who is serving or has served in the military. We have VA loans that can help our veterans to become proud homeowners. There is no requirement for the down payment of this loan and the approval requirements are not strict.

JUMBO LOANS

Some people might need a loan that exceeds the conforming loan limit set on mortgages eligible for purchase by Fannie Mae and Freddie Mac. For them, the Jumbo loan would be a perfect name to go with. The requirements, however, are a bit strict and lengthy but the team of PierPoint Mortgage is there to help you with every challenge.

USDA LOAN

Do you want to build your own house in a rural area? If yes, then USDA loans would be a perfect fit for your financial requirements. This loan is specifically for people having low-income who dreams of becoming a homeowner. In case you fail to get a conventional loan, you can always go for a USDA loan.

REVERSE MORTGAGE

A reverse mortgage is a process that allows senior citizens (62 years of age or older) to obtain cash in exchange for equity in their homes. You can use the amount to pay off medical bills, consolidate debts, or cover any other expense. We provide all types of reverse mortgages, including, HECMs, proprietary, and single-purpose reverse mortgages.

Get All-inclusive Loan Solutions at Pierpoint Mortgage

WHO WE ARE?

Founded in 2003, PierPoint Mortgage, LLC is a leading mortgage company with a network of licensed and experienced mortgage brokers. We pride ourselves on providing excellent services in the mortgage and lending industry to homebuyers across the US.

Why Choose PierPoint Mortgage?

We, as an experienced and adept financial institution, offer a variety of loan solutions and options that can meet your mortgage financing needs. Our team is highly detail oriented. Additionally, we can help you get the best deal starting from the loan origination fee to interest rates on your mortgage.

- Mortgage brokers with accumulated experience of over 50 years

- A wide range of loan and mortgage products

- Hassle-free, straightforward, and streamlined loan process!

- Home loans available at competitive mortgage rates

- Transparent policies

HAVE YOUR DREAM HOUSE IN SIGHT?

Do you want to dream of owning a house but your financial status is restricting you? If yes, then it is the right time to get in touch with the team of PierPoint Mortgage. We are known to be one of the trusted mortgage service providers in the entire USA.

With a healthy record of client satisfaction and an amazing team of mortgage specialists, we have managed to become the #1 priority of people looking for mortgage services. We focus on assisting people in such a way that makes their journey of getting their own house effortless. We have various Mortgage services that can help you build your own dream house.

PierPoint Mortgage cares about the borrowers' needs and that's why we have many different mortgage options that can satisfy the need for financial support. We will help you choose the right loan program, help you get loan estimates, loan terms, and the right direct lender.

What makes us your ideal mortgage company

It can be difficult to find the right mortgage broker in the USA, but it’s an important part of getting a mortgage for a home purchase or sale.

Here’s why we should be your first choice if you are searching for a mortgage company –

We Walk You Through Every Step

For all our clients, especially first-time home buyers, we go out of our way to ensure that our clients are familiar with the mortgage process. You’ll be able to find out what loans you are eligible for as well as how basic the requirements are. You will know which mortgage lender to choose and what is the whole process!

Our Communication is Direct

One of the best things about us is that we are upfront with our clients. You should know that whatever question you ask, we will answer honestly. Building trust between the two of us is fundamentally important for us and that’s what makes us a trusted mortgage company!

Our Team Gets Back to You

A valuable component of our company is responsiveness. At our company, we place great importance on listening to our clients. We often get back to you when we say we would. When you deal with us, you deal with a team dedicated to resolving your queries.

We know What is Best for You

We can determine the best mortgage product to match your requirements and financial situation when you contact us. We make sure to provide you with all the information you need before you apply for a mortgage with us so that you don’t have to spend your time searching the web for the right mortgage.

We Continuously Upgrade Our Knowledge

Mortgages are a field that changes constantly, so staying on top of things is crucial. You will not receive the best possible advice about your various loan options if you do not work with someone who is aware of these changes. This is why we keep ourselves updated. It is our goal to offer the best service to each of our clients.

We Welcome Your Questions

It’s possible to have questions even if you’ve purchased and sold real estate before. In addition to responding to your concerns, we ask you questions to figure out which financing option is right for you.

Bring your dream home to reality, apply for a

mortgage with us

If you are in search of a reliable and expert mortgage broker in the USA, don’t wait for more, and get in touch with our mortgage broker pros for the best assistance. We will assist you in getting the right mortgage as per your requirements and all you have to do is contact us. With a team of excellent and trusted mortgage brokers and lenders, you will get the best guidance throughout the process of your mortgage application.

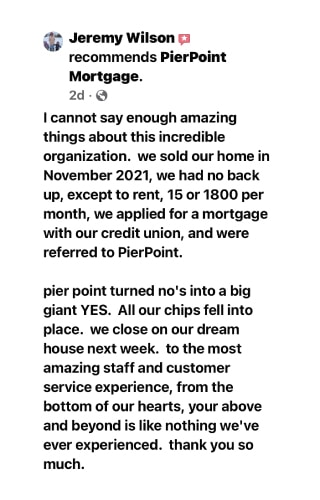

What People Say About Us

We have helped many become proud homeowners. Don't just take our word for it, check the online customer reviews:

Contact Us

LET’S GEAR-UP TOGETHER

If you are spending a lot of time looking for mortgage companies around then your search ends here!

Our team of experts will get in touch with you to get the right mortgage based on your needs right away. Give us a call and avail our excellent mortgage amenities.

WORKING HOURS

9:00am - 5:00pm EST

Sat-Sun Closed

Sat-Sun Closed

LOCATION

3088 Sheffield St. STE B

Muskegon, MI 49441

Muskegon, MI 49441

Got a question? We are here to help.

Have Some Questions?

We Are Always Here To help!

Is a mortgage broker and lender the same?

No, a mortgage broker acts as an intermediary between borrowers and lenders, whereas a lender provides the funds to finance a mortgage directly to the borrower.

Who is the #1 mortgage lender in the US?

It is not publicly available who the #1 mortgage lender in the US is, as this can change based on loan volume and market share. However, PierPoint Mortgage is a reputable mortgage lender with a presence in many states across the US.

Who is the biggest mortgage lender in the US?

Again, it is not publicly available who the biggest mortgage lender in the US is. However, PierPoint Mortgage is a growing mortgage lender with a dedicated team of professionals who work hard to provide quality service to their customers.

What is a lender in a US mortgage?

In a US mortgage, a lender, like PierPoint Mortgage, is the entity that provides the funds to finance a home purchase, and the borrower agrees to repay the loan over time with interest.

What does a lender do?

A lender is responsible for evaluating a borrower’s creditworthiness, determining the amount of the loan, setting the interest rate and loan terms, and managing the loan throughout its life. The lender also has the right to foreclose on the property if the borrower fails to make payments as agreed.

Is it worthwhile to use a mortgage broker?

Yes, it can be worthwhile to use a mortgage broker. A mortgage broker will not only help you find the best loan products that match your needs, but they also have the ability to access and compare more loan products than you would on your own. They can provide you with comprehensive advice on which loan product is best for your situation, as well as offer tips and strategies to ensure you get the most competitive interest rate available. Plus, their services are typically free or at low cost. Mortgage brokers are knowledgeable in the field of loans and can point out features and costs that may be overlooked when researching on your own. By using a mortgage broker, you can save time and money while helping make sure you get the right loan for your unique financial goals.

At what point should I see a mortgage broker?

At what point should you go to a mortgage broker? This is an important step in the home buying process. A mortgage broker can help you determine what type of loan makes sense for your situation, as well as what kind of down payment and interest rate are reasonable. They can also provide guidance on credit scores and debt-to-income ratios, which will be vital in securing a loan from a lending institution. A broker may also be able to negotiate better terms with lenders than you could on your own, which can save you money over the life of your loan. Going to see a mortgage broker early in the home buying process is recommended so that they have plenty of time to work with you on getting the best possible deal.

Why is getting pre-approved for a mortgage important?

Getting a mortgage pre-approved is an important step when exploring the home-buying process. Pre-approval can help you understand your budget and make sure you don’t end up spending more than what you are comfortable with. It also helps in strengthening your negotiation position with sellers since it shows them that you are serious about buying and have already been approved for a loan amount.

In addition, getting pre-approved before making offers to purchase property allows potential buyers to move quickly when they find their dream home or a great investment opportunity; this is especially beneficial given that there is often competition for desirable properties in today’s real estate market. Securing pre-approval provides peace of mind knowing how much money will be available to put towards a down payment as well as closing costs associated with the purchase of the home.

Getting pre-approved requires borrowers to provide supporting documents such as bank statements, W2s, pay stubs, tax returns, valid photo IDs, etc., which must then be verified by lenders in order to approve them for any loan amount or rate structure they qualify for. This can take anywhere from 1 – 2 weeks depending upon the lender and accuracy of documents submitted. However, it’s worth taking the time upfront and gathering all necessary paperwork if you want the best deal on your mortgage since being able to demonstrate ability to pay back borrowed funds over an extended period gives lenders confidence in extending approval amounts/rates at lower interest rates than those who may lack financial history documentation.

Once approved borrowers have flexibility when searching for properties within specified budgets set forth by lenders based on creditworthiness; providing security throughout each step of the homebuying journey while ensuring affordability even during times when market prices appreciate rapidly (i.e., bidding wars). All thanks go out to convenient tools such as online visits offered through many banks allowing quick access anytime/anywhere when tracking progress along the journey from getting pre-approved right to purchasing desired property!

How do I find reputable mortgage brokers near me?

When looking for a reputable mortgage broker near me, it’s important to take into consideration the different services they offer, their reputation in the industry, and how affiliated they are with local lenders.

First off, make sure to find out what types of mortgages the broker can provide – whether it’s fixed-rate mortgages, adjustable-rate mortgages (ARMs), reverse mortgages, or other specialty loans. Some brokers might have access to multiple products and programs from several lenders while others may only work on behalf of one. Also, make sure you know exactly what kinds of closing costs are involved and who will be responsible for paying them; some brokers might be able to negotiate more favorable terms than others.

Another key factor is researching your potential mortgage broker’s credentials – including any certifications or licenses they hold as well as their track record in the industry. Reviews online from past customers can tell you a lot about how reliable a mortgage broker is overall and whether previous clients would recommend their services. Be wary if there are lots of negative reviews since that could mean there may be issues working with them in the future.

It’s also important to check if your potential broker has ties with local lending institutions as this could potentially impact both approval rates and loan terms available; many times local lenders are more likely than big banks or financial companies located elsewhere to offer better rates for qualified borrowers since they understand market conditions at an intimate level. Finally, be sure that your chosen mortgage broker understands local regulations pertaining to home loans applicable within your state. Ask questions about these areas before signing any agreements so you fully understand all aspects involved before committing to anything long-term financially speaking!